vermont income tax return

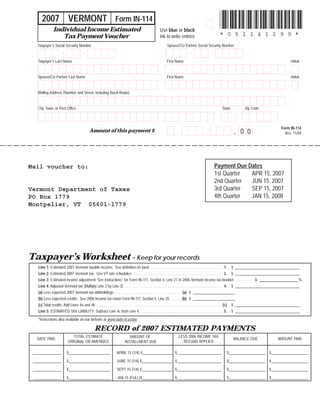

Details on how to only prepare and. Box 1881 Montpelier Vermont 05601-1881.

Vt Dept Of Taxes Vtdepttaxes Twitter

And you are enclosing a payment then use this address.

. The Federal or IRS Taxes Are Listed. Vermont income taxes are imposed on individuals and entities taxpayers that vary with the profitable income. However if the fiduciary files the return after.

Vermont Individual Income Tax Provisions. This method allows married couples to combine their income into a. If you file a.

A Every individual trust or estate subject to taxation for any taxable year under section 5822 of this title shall file a Vermont personal income tax. Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers. And you are not enclosing a payment then use this address.

If you are due a refund or dont owe any tax mail your return to Vermont Department of Taxes PO. Estates and Fiduciaries - A fiduciary is allowed to file a Vermont income tax return up to 60 days after the original due date without an extension. 31 2021 can be e-Filed along with an IRS Income Tax Return by the April 18 2022 due date.

Local Option Tax Finder. 2021 Tax Year Return Calculator in. And you are filing a Form.

Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets. Prepare and e-File Vermont Tax Return. A Vermont Income Tax Return must be filed by a full-year or a part-year Vermont resident or a nonresident if you are required to file a federal income tax return AND.

Vermont State Income Tax Forms for Tax Year 2021 Jan. The State of Vermont has put out a press release regarding the filing of income taxes as well as some useful information for filing. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

Use a tax professional or volunteer assistance to prepare and file your return. Vermont State Income Tax Return forms for Tax Year 2021 Jan. 15 Tax Calculators 15 Tax Calculators.

2021 Tax Year Return Calculator in. 185 rows 2021 Income Tax Return Booklet 2021 Vermont Income Tax Return Booklet. Additionally did you know that about 65 percent of Vermont.

See Applicable State Tax Forms Deadlines and Other Important Details. Returns by individuals trusts and estates. IN-111 IN-112 IN-113 IN-116 HS-122 RCC-146 HI.

The Vermont Income Taxes Estimator Lets You Calculate Your State Taxes For the Tax Year. Vermont assesses state income tax on its residents using a joint filing system. Understand and comply with.

You earned or received. The 2022 state personal income tax brackets. IN-111 can be eFiled or a paper copy can be filed via mail.

Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Adjustment Claim Renter. This booklet includes forms and instructions for. We last updated the Vermont Personal Income Tax Return in.

If you live in Vermont. Form IN-111 is the general income tax return for Vermont residents. If you cant file your.

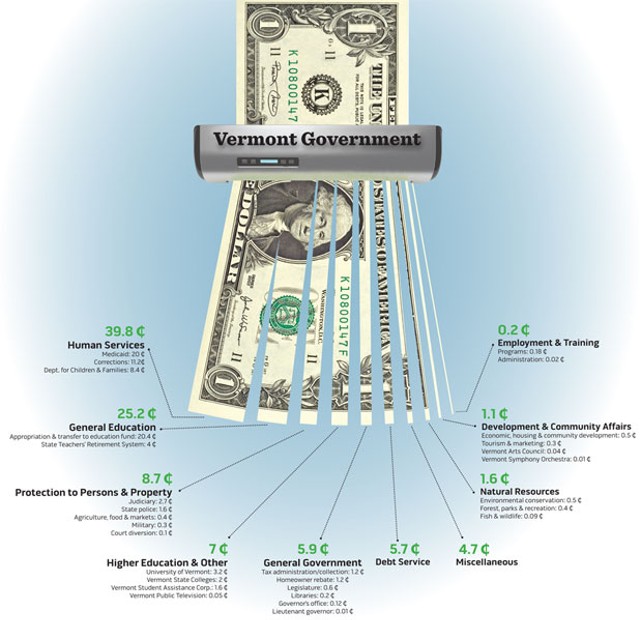

Where Do Your Vermont Income Tax Dollars Go Politics Seven Days Vermont S Independent Voice

Filing Season Updates Department Of Taxes

Would Be Governors Miss Vermont S New Ethics Law

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Vt Tax Form E2a Fill Online Printable Fillable Blank Pdffiller

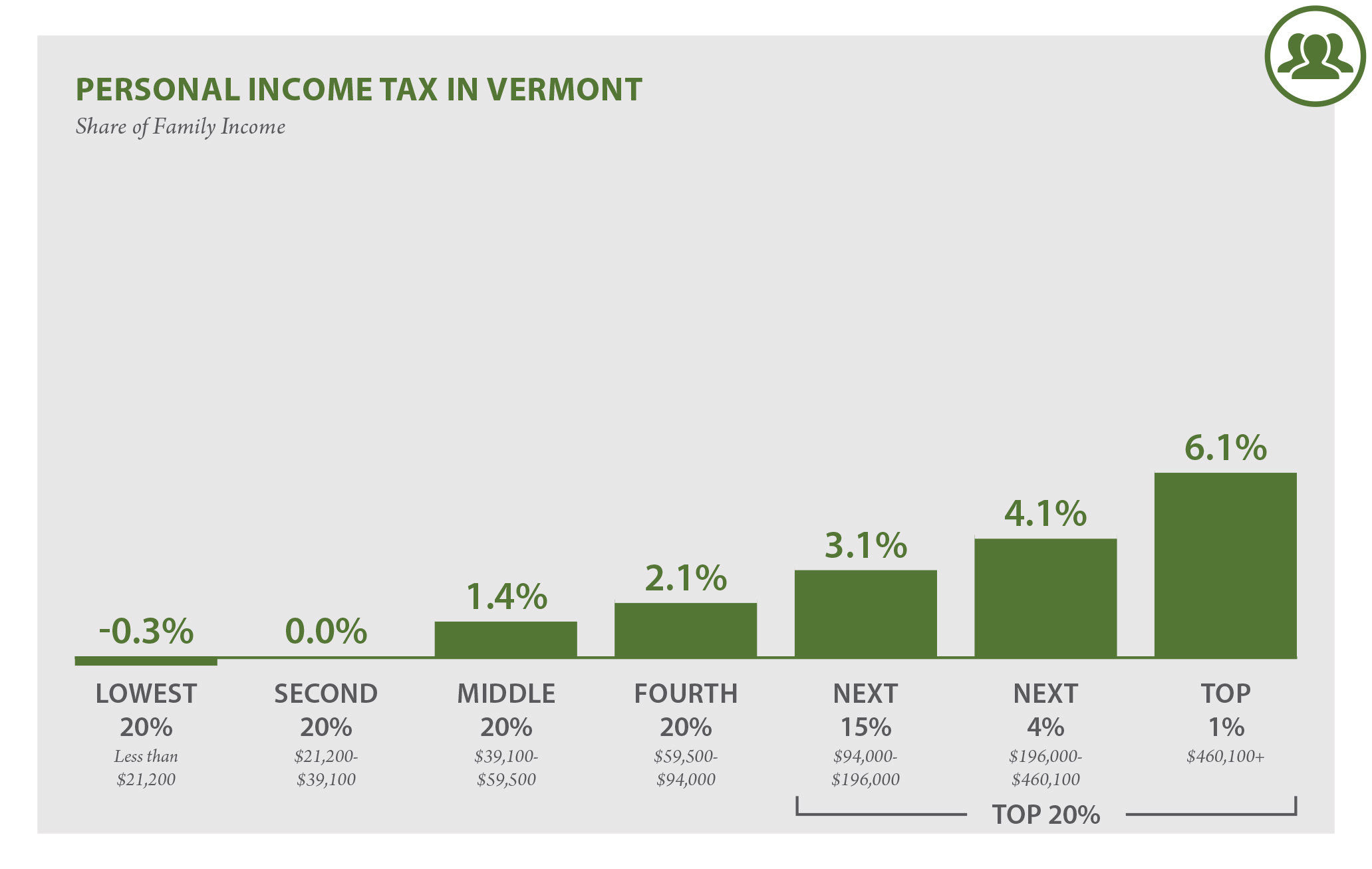

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute

Vermont Department Of Taxes Montpelier Vt Facebook

Free Form In 151 Application For Extension Of Time To File Individual Income Tax Return 2011 Free Legal Forms Laws Com

Vermont Who Pays 6th Edition Itep

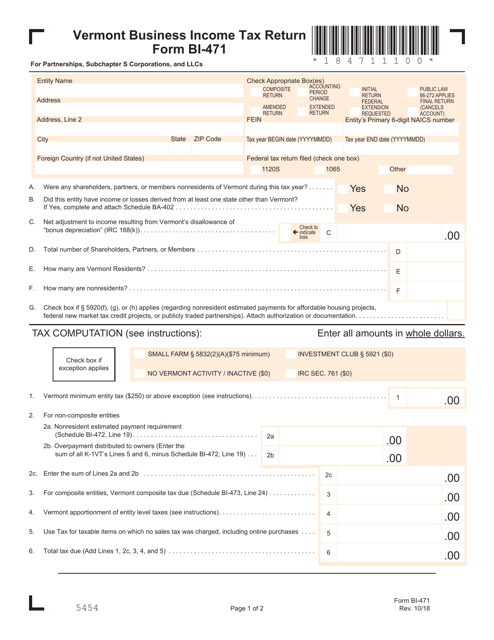

Vt Form Bi 471 Download Printable Pdf Or Fill Online Business Income Tax Return Vermont Templateroller

Vt State Tax Form Information Town Of Cave

Vt Form In 111 Download Fillable Pdf Or Fill Online Income Tax Return 2018 Vermont Templateroller

Vermont Income Tax Form Fill Out And Sign Printable Pdf Template Signnow

Vermont Department Of Taxes Free File Is Still Available For Eligible People Who Have Not Filed Their 2018 Income Tax Returns Whether Or Not They Received An Extension To File To

/cloudfront-us-east-1.images.arcpublishing.com/gray/AUU4WKVNHRIORAI46KVTDIHJH4.jpg)

What S That Vt Use Tax Letter And Do You Have To Pay

In 151 Extension Of Time To File Vt Individual Income Tax Return